Ms Dogniez was the featured speaker in the MSF’s Sustainability Reporting module on 28 January, focusing on how businesses benefit from disclosing and communicating their ESG goals. “Sustainability reporting is too often viewed as a public relations exercise, but in fact it helps companies engage with stakeholders who are placing more emphasis on sustainability matters,” clarifies Ms Dogniez.

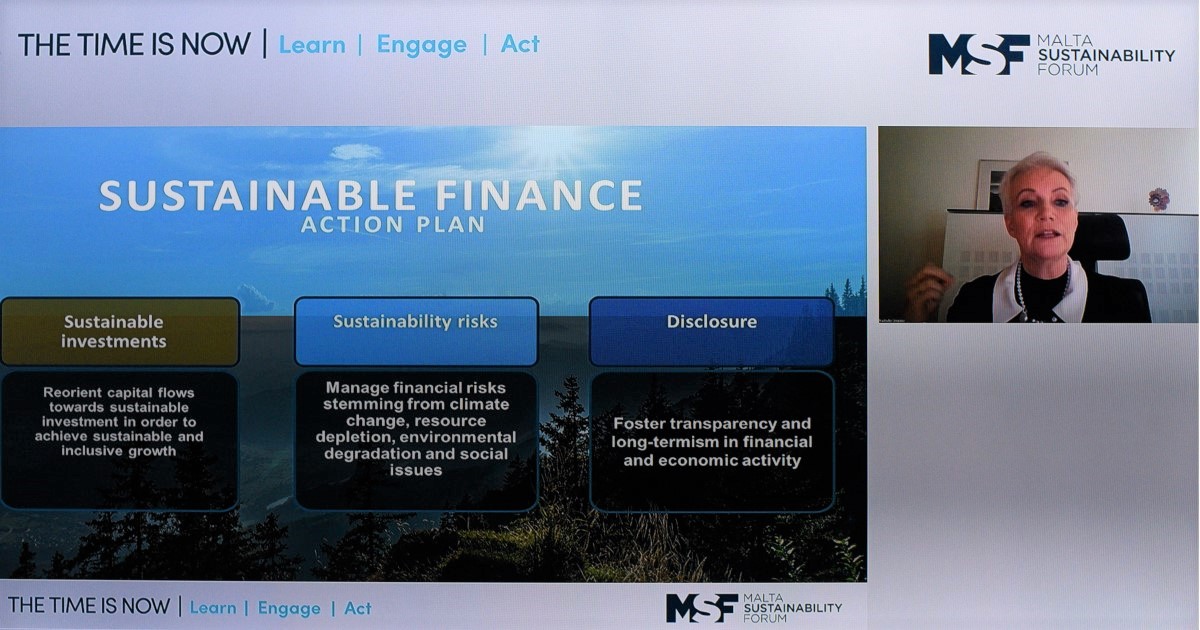

“Company performance is increasingly assessed as a combination of financial and non-financial key performance indicators. The latter will increase further with the review of the non-financial reporting directive (NFRD), beyond the focus being placed on sustainability measurements for the financial sector through the Sustainable Finance Action Plan. Consequently, businesses that can demonstrate sustainability alignment will get easier and cheaper access to financing.

“From a stakeholder perspective, interested parties like investors, suppliers or customers benefit from insight into an organisation that goes beyond financial elements. Thanks to effective ESG goals, stakeholders can be confident that the company they’re investing in, working for or buying from aligns with their own purpose. So, without an ESG strategy that embeds sustainability within business objectives, non-financial reporting risks being a vain exercise, focusing on anecdotal aspects rather than measuring a company’s real impact.” Although she comes from a traditional asset and wealth management background, the PwC Partner has found that ESG has permeated most areas of her work, including financial services. “ESG represents one of the largest fundamental changes in the investment landscape,” she explains. “The trend of attributing strategic focus to sustainability issues, which we’ve seen among stakeholders in the asset management landscape, will soon be mirrored by retail investors as millennials enter the investor base. Consequently, I’ve had to keep pace with sustainable finance in order to advise financial market participants on how to seize this strategic market opportunity.” Despite the subject’s pressing nature, Ms Dogniez remains positive that organisations will embed sustainability within their strategy, products and operations in 2021. “The COVID-19 crisis has forced businesses to rethink their purpose, and post-COVID-19 recovery will have a strong sustainability component – starting with a contribution to CO2 emissions reduction. Looking ahead, successful companies will be those that have effectively embedded sustainability within their operations and designed adequate sustainability reporting processes,” she concludes.